The 3-Minute Rule for Personal Loans Canada

Table of Contents6 Simple Techniques For Personal Loans CanadaThe Best Strategy To Use For Personal Loans CanadaSome Known Details About Personal Loans Canada The 5-Second Trick For Personal Loans CanadaPersonal Loans Canada - The Facts

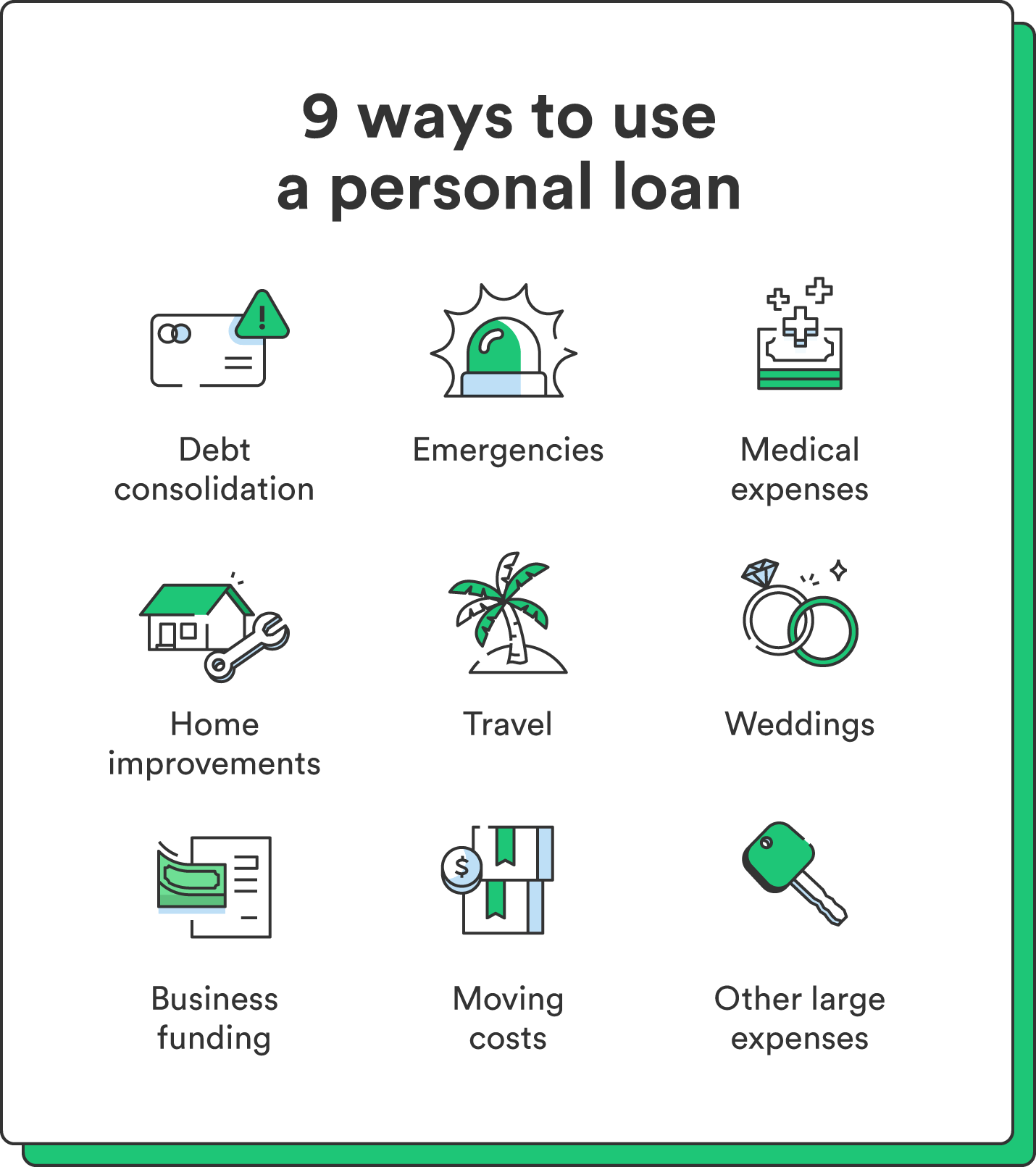

Repayment terms at a lot of individual financing lenders vary in between one and 7 years. You receive all of the funds at the same time and can use them for almost any kind of objective. Borrowers usually utilize them to fund an asset, such as a lorry or a watercraft, pay off debt or help cover the expense of a major expenditure, like a wedding or a home remodelling.

A fixed rate offers you the security of a predictable month-to-month repayment, making it a prominent choice for settling variable price credit report cards. Repayment timelines vary for individual fundings, yet customers are commonly able to select settlement terms between one and seven years.

The Basic Principles Of Personal Loans Canada

The charge is normally deducted from your funds when you complete your application, reducing the quantity of cash you pocket. Individual loans prices are extra directly connected to short term prices like the prime price.

You may be used a reduced APR for a shorter term, due to the fact that lenders recognize your equilibrium will certainly be settled quicker. They might bill a greater rate for longer terms recognizing the longer you have a financing, the more probable something might change in your financial resources that can make the payment unaffordable.

An individual lending is additionally a good choice to using bank card, since you obtain money at a fixed price with a certain reward date based upon the term you pick. Bear in mind: When the honeymoon mores than, the regular monthly settlements will certainly be a reminder of the cash you invested.

Personal Loans Canada Fundamentals Explained

Before taking on financial obligation, make use of a personal finance settlement calculator to aid budget plan. Gathering quotes from numerous lending institutions can aid you detect the best deal and potentially save you interest. Contrast rate of interest rates, costs and lender credibility prior to requesting the car loan. Your credit rating is a large variable in determining your qualification for the lending along with the rate of interest.

Before using, recognize what your rating is to make sure that you understand what to anticipate in regards to costs. Watch for hidden charges and penalties by reviewing the loan provider's terms and conditions page so you don't finish up with much less cash money than you require for your economic goals.

They're simpler to qualify for than home equity finances or other secured loans, you still need to show the lender you have the ways to pay the loan back. Individual financings are far better than credit history cards if you want an established month-to-month settlement and require all of your funds at when.

Personal Loans Canada Fundamentals Explained

Charge card might be much better if you need the flexibility to attract more tips here cash as required, pay it off and re-use it. Debt cards may also provide benefits or cash-back alternatives that personal fundings don't. Inevitably, the most effective credit report product for you will depend on your cash habits and what you require the funds for.

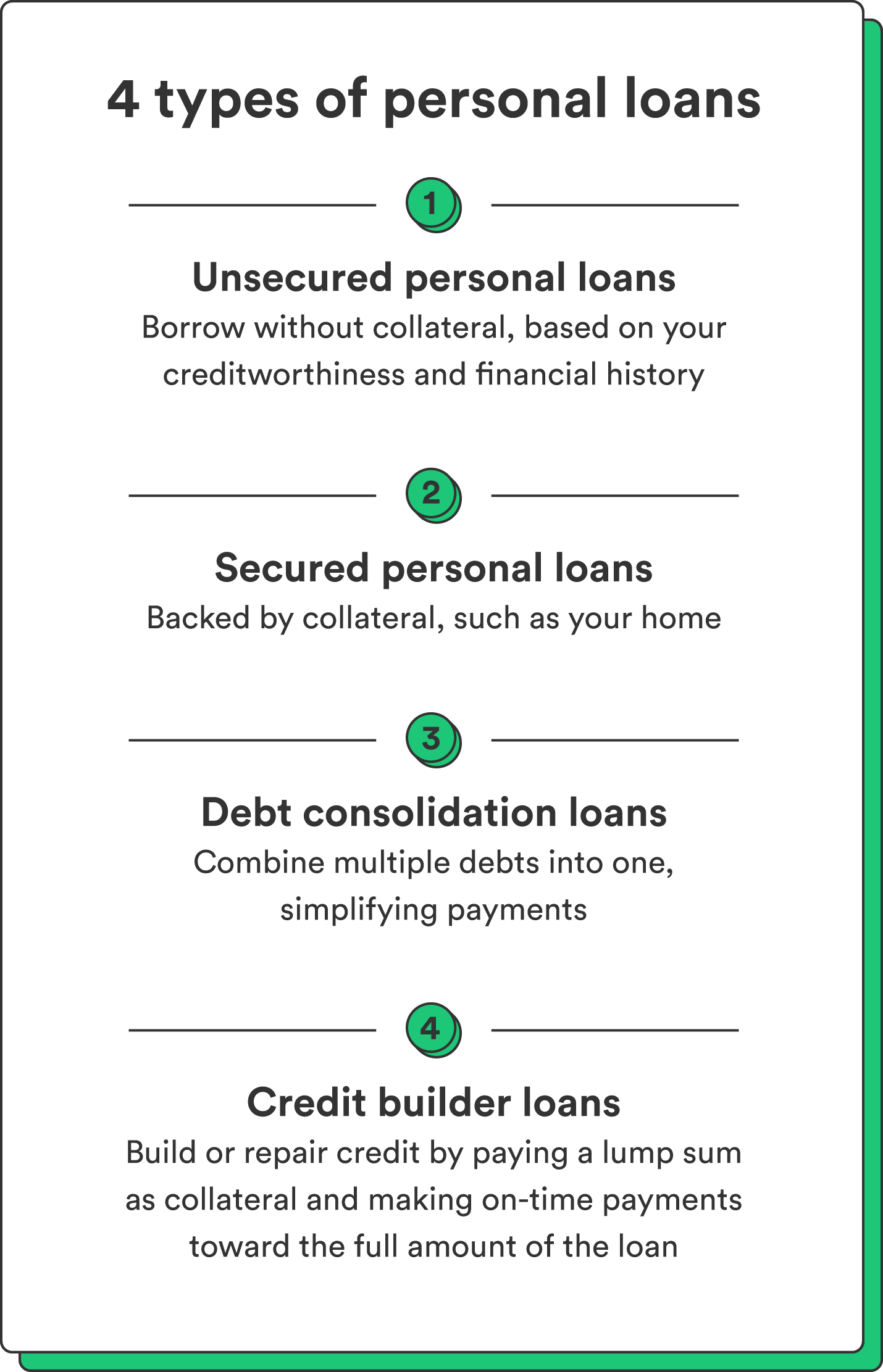

Some lending institutions may additionally bill fees for personal fundings. find here Personal car loans are fundings that can cover a variety of personal expenses. You can find individual fundings with financial institutions, lending institution, and online lending institutions. Personal car loans can be secured, suggesting you need security to borrow cash, or unsecured, without collateral required.

, there's normally a set end day by which the loan will certainly be paid off. An individual line of credit report, on the other hand, might stay open and available to you indefinitely as lengthy as your account remains in excellent standing with your loan provider.

The cash gotten on the car loan is not taxed. Nevertheless, if the lender forgives the finance, it is thought about a canceled debt, and that quantity can be taxed. Individual lendings may be protected or unprotected. A secured individual financing needs some kind of collateral as a problem of loaning. For circumstances, you might secure an individual funding with cash possessions, such as a financial savings account or deposit slip (CD), or with a physical asset, such as your vehicle or watercraft.

The Definitive Guide for Personal Loans Canada

An unsafe personal loan calls for no security to obtain money. Financial institutions, credit unions, and online lending institutions can use both secured and unprotected individual fundings to qualified debtors.

Again, this can be a bank, cooperative credit union, or online personal car loan lending institution. Typically, you would certainly initially complete an application. The lending institution evaluates it and determines whether to accept or reject it. If approved, you'll be provided the car loan terms, which you can approve or turn down. If you consent click reference to them, the next step is finalizing your finance documentation.

Comments on “Little Known Facts About Personal Loans Canada.”